Start small and stick with it.

One of the best college savings strategies is, simply, to start. The earlier you save, the more time your money has to potentially grow. This is the power of compounding—when your returns earn more returns and so on.

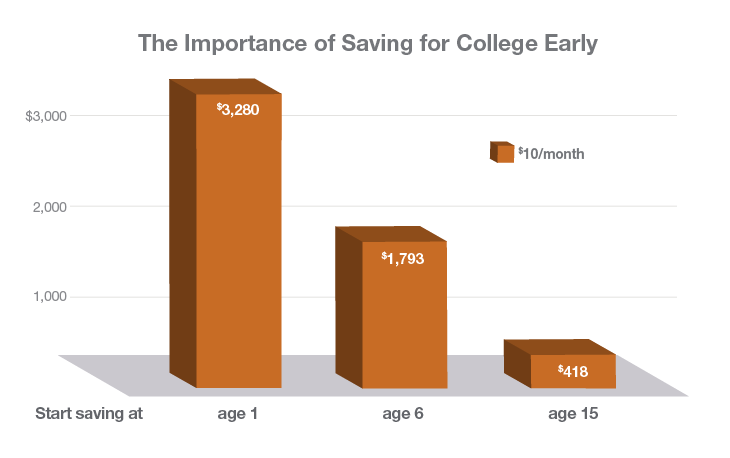

Let’s say, with an assumed annual return of 5%, you began saving $10 a month when your child was 1 year old (with an initial contribution of $250). At this saving rate, your 529 college savings plan could potentially have an account worth $3,280 by the time your child is college age.1

Managing to save even a small contribution each month is a far better plan than borrowing all of what you'll need when the time comes. Our College Savings Planner is an easy way to help you:

- Find out how much college could cost when your child reaches enrollment age

- See if you are on track to reaching a college savings goal

- Show how saving now can significantly reduce the amount you may need to borrow.

Get started with the College Savings Planner now.

It’s never too late

Remember — it’s never too late to save. Even a small contribution each month can cost much less than borrowing all of what you will need when the time comes. No matter how small the saving, you'll feel good knowing that you’re preparing for the future. So why not start today?

1 This hypothetical example is for illustrative purposes only and assumes no withdrawals made during the period shown. It does not represent an actual investment in any particular 529 plan and does not reflect the effect of fees and expenses. Your actual investment return may be higher or lower than that shown. The loan repayment terms are also hypothetical.